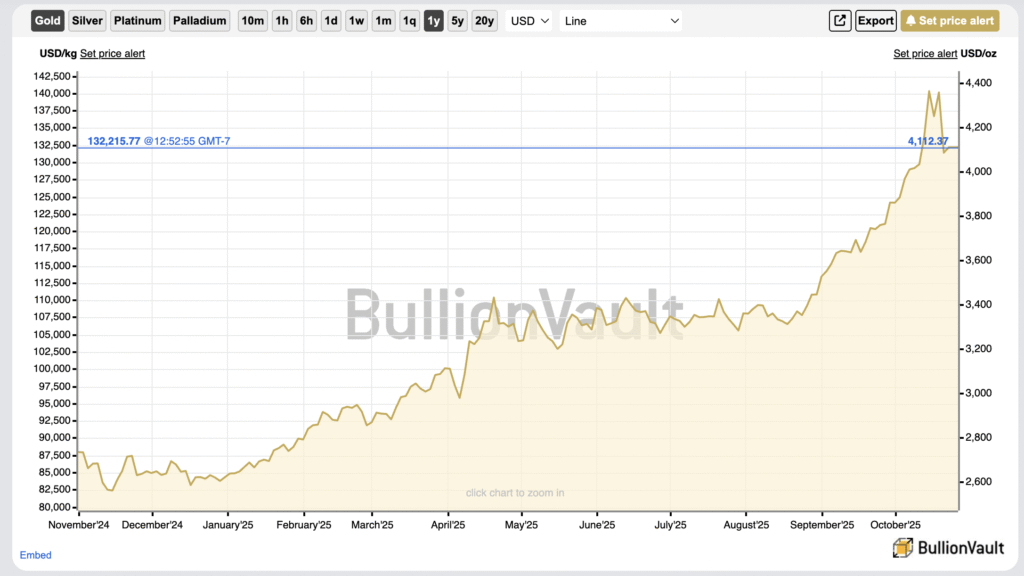

The Price of Gold Has Skyrocketed in Recent Months

On October 31st, 2024 the spot price of gold was ~$2,736/oz, it traded sideways for 3 months, rallied to ~$3,434/oz on April 19th, 2025, traded sideways for another 4 months, then pushed to a new all-time high, reaching ~$4,365/oz on October 14th, 2025. At time of writing the price has corrected slightly and sits at ~$4,112/oz.

Chart Source: https://www.bullionvault.com/gold-price-chart.do

I do not currently own any gold. But when you see this sort of price action, money hungry capital allocators like myself begin to take a second look at the shiny metal. Here’s why…

Some Background Information on Gold

Gold is a very unique asset in that it used to be money. Today there are dollars and there is gold, in the old days it was just gold, it was the currency. Well technically, early civilizations used a number of wild and wacky materials as currencies, but gold ultimately won out in the societal line that has led to modern times. This is for a number of reasons, with scarcity, durability, malleability, and beauty most cited. However, a crucial component of gold’s victory was that it was used by the nations which have proven to be most influential on global affairs. Simply put, the societies that settled on gold as their currency material won.

Why Did We Move Away From Gold?

So, if Gold “won”, why are we not using it as a currency today?

Gold suffered from many of the same practical limitations that the US Dollar suffers from. Although the currency of the United States is technically the US Dollar, I almost never use it to pay for things. Using actual US Dollars for purchases would require me to carry US Dollars when I go to buy things. Today, modern technology and financial innovation is making paper currency redundant. I can pay with card almost everywhere in the country, I can pay with my phone at the places I tend to shop at, and I can pay with my watch anywhere I can pay with my phone. In fact, most of the money that leaves my bank account does so at the command of a few clicks on a computer or a few taps on my phone. Yes, I am technically paying for things with USD, but I am not using US Dollars, I am using derivative instruments that do the job better.

When you pay with US Dollars you need the physical paper with you, of value sufficient to complete the necessary transaction, in denomination that allows the counterparty to provide you with change. You have to protect US Dollars, make sure not to lose them, and ensure any of the currency you receive is real and accurate. Most importantly, your counterparty has to accept them as a method of payment. Although the US Dollar claims to be “legal tender for all debts, public and private”, I do not think the company which maintains my brokerage account would appreciate receiving envelopes full of cash every time I go to deposit money. You may even get turned down or flagged by AML (Anti-Money Laundering) if you try to complete big ticket purchases using cash.

Image Source: “Dollar Bill (Front)” by Sarah Corriher, CC BY 2.0

Like the move away from cash, people moved away from using gold as a currency for convenience and protection. Why deal in gold when you could keep your gold stored safely in a vault, receive a piece of paper indicating you were good for it, and use the paper in place of the gold? As paper currencies proved more convenient than gold, they were widely adopted and the gold backing part of the deal became little more than a nuisance for powerful economic forces. Particularly central banks, whose ability to issue currency was constrained by the amount of gold they had in their vaults.

The killing blow was dealt when the US Department of Treasury accumulated a great sum of gold deposited by other countries in exchange for US Dollars and did not want to give it back. Some speculate that the US issued more dollars than it had gold. The French lost faith in the system and quietly converted a significant portion of their US Dollars. In response, unwilling to risk a full run on the bank, the US “suspended” the convertibility of US Dollars to gold. Today, no currencies are backed by gold and the system has gone from “this dollar represents gold you have in a bank” to “I have gold in a bank, it is not yours, but you can use this dollar for transactions”.

What Is Gold now?

Fast forward to modern times, what is gold?

Gold is the shiny metal that used to be the dominant material for currency. With the United States’ haste in abandoning the gold standard, the prevailing global monetary regime relies purely on their economic and military power. This is less secure than many would like and some people think that we should not count gold out. Gold continues to be valued as the shiny metal alternative to paper currencies worldwide. If something were to happen to the United States and the US Dollar’s status as reserve currency, it is presumed that gold would make a serious comeback.

The Idiosyncratic (Unsystematic) Risk Of Gold

As stated previously, gold is an alternative to national paper currencies, most significantly the US Dollar. But aside from the fact that pretty much everyone in the world values it as an asset, it has little value as an asset. It is a shiny metal that has some use cases in terms of electronic components, décor, and jewelry. However, if you went out and bought an ounce of gold today as an investment, that ounce would not do anything. You could watch it for days or years, in the light or the dark, it just sits there. It does not produce anything, it does not self-replicate, it will not do your chores, feed you, or improve your business. Gold is an unproductive asset. That is part of what investors love about it.

Because the bar for what gold will actually do for you is so low, you do not have to worry about it doing it good or bad. The price of gold may move around, but the gold itself is guaranteed to just sit there. This means that gold as a whole has almost no idiosyncratic risk. Idiosyncratic risk being the risk that a given asset experiences, independent of the larger market for assets. The government could make gold illegal to own and someone could steal your gold. Assuming that does not happen, your gold will sit there until you sell it. Compare this to a share of stock, which represents ownership of a company, which could do bad even in a good market, if the company is mismanaged or has poor economics. You do not need to micro-manage gold and the economics are simple.

The Market Risk (Systematic) Risk Of Gold

If gold just sits there, what determines its price volatility?

Isn’t there a risk that I will not get my money back when I go to sell it?

This is where gold gets complicated. Because it just sits there, its value is determined by the market for it, not by the market for what it produces. Where a coffee company is valued based on the market for coffee and the efficiency to which it meets the market, gold is valued based on the market for gold. So, if you are thinking about gold in terms of US Dollars, you are thinking about it the wrong way. Gold should be examined as an alternative to US Dollars, not a store of US Dollars. Many people look at Gold as a “store of value”, but its ability to meet this definition historically has simply been a result of the market for gold.

As of today, gold has a $28.694 Trillion USD market cap. Chances are that you are a small fish compared to that number. What determines the price volatility of gold is how the supertankers are feeling. If the United States decided to re-invoke the gold standard (something they are unlikely to do given it would show how much they have diluted their currency, to the detriment of the rest of the world, and in all probability the majority of their populace), that would make a difference in the price of gold. If George Soros anticipated this and levered up to take advantage of the upcoming price action, he might move the needle with the wave he creates as hundreds of whales follow in his wake. If the US embraced disastrous economic policy, abdicating its role as the economic superpower of the world, and its enemies took advantage of this, buying up gold, and calling for a return to the shiny metal as a standard, that would move the needle. The market moves on whispers and suspected changes in the international world order.

In addition to actual fluctuations of supply and demand in the gold market, there is the gold edge. The “gold edge” being a term used here to encompass the tendency of storied unproductive assets, like gold, to continue performing in accordance with their history. Many view holding gold as a good alternative to paper currencies. If a given currency experiences inflation, people will look to gold for protection. If the US Dollar experiences a significant amount of inflation, the populace assumes gold will protect them. In reality, this protection is not a given, but has persisted across history due to the actions of whales and supertankers.

The Best Part Of Gold

Getting back to the practicality of assets, where people only really care about the currency that pays their bills and buys them stuff, gold has a very valuable and unique characteristic as an asset.

When the stock market rallies, you have to be watchful for a crash or correction. If you need money in a crash and have to sell your stocks, you are going to get less than you would have during the peak of the rally. Nobody plans on selling at the bottom, but that is generally when you most need the money. People are more likely to lose their job at the bottom of the market than at the top, this reflects the systematic and unsystematic risk profile of your employment. If you lose your job at the bottom, you may have to sell your stocks at the bottom to pay for your living expenses. This is an example of two hits to the gut at the same time, which sometimes happens in life. How do you avoid this? The answer is antifragile assets.

Nassim Nicholas Taleb is most credited with the introduction of antifragile assets as a concept when he coined the term in his 2012 book Antifragile: Things That Gain From Disorder. The concept is self-explanatory: when the market goes down, some assets go up in value. Gold has antifragile characteristics. The behavior of assets during market sell-offs is case-by-case, but chances are that if stocks sell off, gold will outperform them. This is more complicated than a rule of thumb, but nonetheless gold is broadly seen as a safe haven amongst capital allocators worldwide.

As mentioned previously, gold does not do anything, so it cannot perform poorly on a fundamental basis during a bear market. Knowing this and anticipating that countries will try to inflate their currencies to escape economic crisis, whales often rush to gold in periods of market instability. Gold is a low-cost way of abstaining from participation in broader asset markets.

The anti-fragility of gold is incredibly valuable. “Yeah, your gold is up now, but what happens when the economy tanks”? If “the economy tanks” asset allocators rush to safer assets like gold and the gold is worth more. There may be a delay as whales typically move from risk-on assets like stocks to US Dollars, holding them for a period of time to show financial strength and liquidity, and then proceed to assess less-liquid safe havens based on the causes of instability. But the bottom line is that when stocks go down, there is a significant chance that gold will go up. If you held gold and stocks into the crash, you get punched in the gut as your stocks sell off, but get to punch back when your gold rallies.

So what happens when stocks go up?

In that case, it depends on why stocks are going up. If stocks are going up because the United States is inflating its currency or borrowing money to spend it inefficiently, there is a good chance that gold will go up in price. But this scenario is more reliant on the supply & demand forces of the moment. In some situations, the cost of not participating in the stock market is so high that allocators simply cannot afford to convert their money to gold. Which brings us back to the core price drivers of gold, the larger market forces acting on it.

The Opportunity Cost Of Gold

If gold can do well in times of growth and in times of instability, what is the downside?

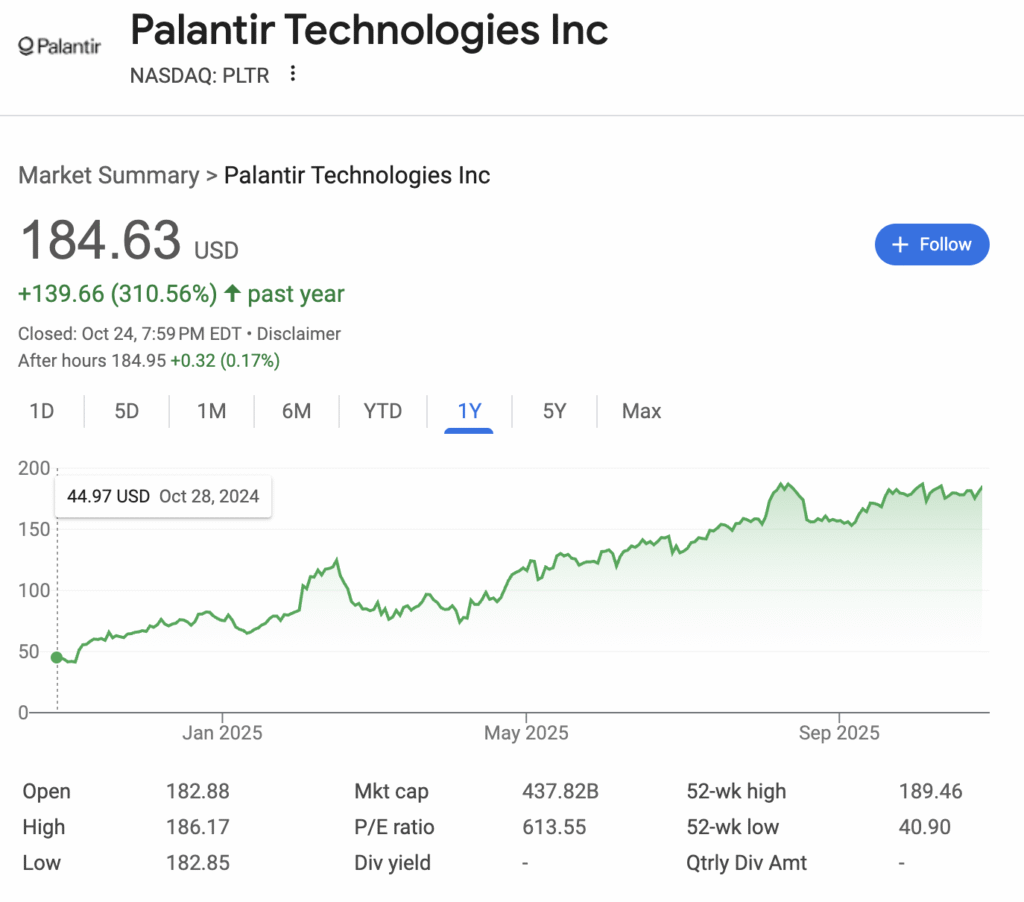

The fundamental problem with gold is the unproductive nature of the asset. As stated previously, unproductive assets have no risk of performing poorly as assets on a fundamental level. They are not designed to do anything, so there is no risk in them doing it poorly. Well, “risk” is a double-edged sword and in the world of assets, somewhat correlated with “opportunity”. Although a productive asset can perform poorly, it can also perform well. If you are willing to take the risk on a productive asset, its returns are fundamentally geared toward outperforming unproductive assets. Productive assets produce things of value, that is valuable and so is the risk of doing it. If you find returns of 50% year-over-year to be impressive, I encourage you to look at the performance of Palantir (PLTR) over the same period, it is up ~310%. That is the true cost of holding gold. That your returns will be dwarfed by that of productive assets. That the people willing to take risk will be compensated for it.

Chart Source: Google.com https://share.google/PaZpsVSkCOu3ZKKKl

In fact, because gold does not actually do anything, it is questionable whether you are providing any value by holding it. Some could argue there is a net decrease in societal value by holding shiny metals instead of deploying capital for productive purposes. But this risk can be much more tangible than that. Viewing gold as an alternative for US Dollars, there is a chance that your US Dollar expenses will increase in line with the appreciation of your gold, and in some cases, at a greater rate than your gold.

The Liquidity Cost Of Gold

Let’s bring things back to reality, you need US Dollars to pay for things. Gold is an alternative to paper currencies but chances are that you will have a hard time finding a counterparty for your typical transactions that accepts gold as a form of payment. You cannot just convert all of your US Dollars to gold, or at least, not for as long as you have expenses. The closest anyone can get to this is taking out a loan, using gold as collateral, then making payments on the loan by converting gold to cash. This is not available to most people and merely reduces the number of dollar transactions you make through the use of other people’s money.

Furthermore, every time you buy gold, you need to pay a bit over the spot price and every time you sell gold you will receive a bit under the spot price, so if you buy and sell 1,000 times for a given spot price, you are going to lose a fair amount of money. If you want to get more US Dollars when you sell than when you bought, you have to hold the gold until you have a higher spot price to offset this spread. This adds another layer of complication to the price volatility of gold because you cannot convert dollars to gold and back over a zero period of time without losing money. This loss on entry and exit is significant when compared to stocks and certainly when compared to simply holding cash.

Given that you will need at least some paper currency, whether you should hold any gold becomes a serious question. The day will come when you will need dollars and gold is not dollars. If you need the dollars very fast, the gold is not worth much. If you have some time to liquidate the gold you might not get the best price, but you can do it. If you have plenty of time to liquidate the gold, you can try and hold out for a better price. But if you have time to hold out for a better price, why not hold a productive asset, which is engineered to have greater price performance over the long run? The reality is that most of the times you will need dollars, you will need them relatively quickly.

The Surprising Expense That Has Kept Up

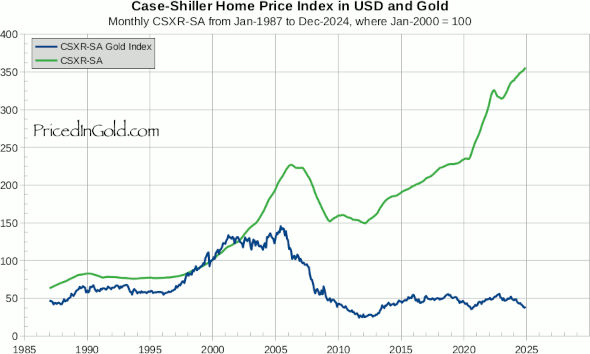

Chart Source: https://pricedingold.com/us-home-prices/

The website www.pricedingold.com shows how a variety of assets have performed if you priced them in gold, relative to if you priced them in US Dollars. As the above chart indicates, the Case-Shiller Home Price Index currently shows little price change since 1987 if you priced it in gold. What this means is that gold buys just as much home today (in 2025) as it did in 1987.

The Case-Shiller Home Price Index looks at repeat sales on single family homes as a national average, so individual homes and communities will experience their own economics. But absent any unique, short-term, market flare ups in gold or housing, I do not expect these two metrics to ever differ significantly under the current monetary regime. What the US Government fundamentally did by removing the US Dollar’s peg to gold was peg the US Dollar to the performance of the American economy. The American economy is driven by the American people and the thing driving most people is the desire to own or maintain a roof over their head. The Federal Reserve can print as many dollars as they please, it does not seem to have much of an effect on the creation of gold or land. From what I can tell housing is primarily determined by the regulatory authorities, location, and its own supply & demand economics.

The Kiyosaki Story

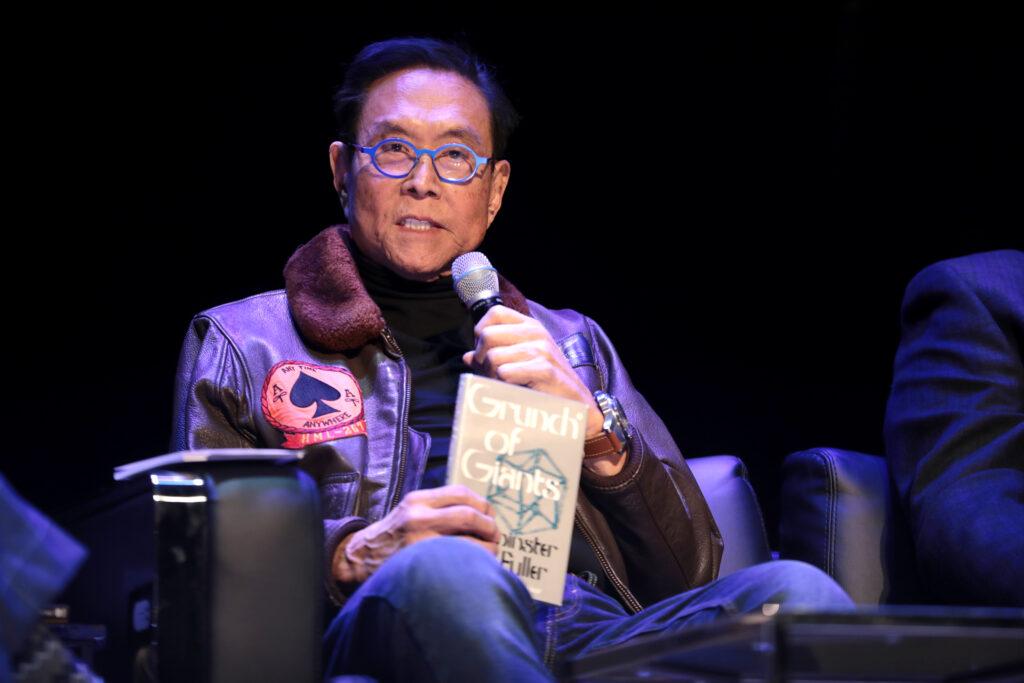

The performance of gold relative to Case-Shiller’s Home Price Index provides us with a few valuable insights. Primarily, gold has done well over the long term, but Case-Shiller’s Home Price Index has kept up. Holding gold on its own has not increased one’s ability to purchase a home. But maybe just maintaining your ability to purchase a home is enough. If you are managing your money in such a manner where you are trying to set aside money over the long term in order to purchase a home, knowing that gold might fill that need better than US Dollars or a High Yield Savings Account can make a huge difference. When featured on The Iced Coffee Hour (a podcast hosted by Graham Stephan and Jack Selby), Robert Kiyosaki of Rich Dad Poor Dad fame revealed that he purchased his $4.5 million home using gold that only cost him $450,000. We are not given the timeframe he held the gold, or the buy and sell price, but from what we are given, that does not sound like a bad deal.

Image Source: “Robert Kiyosaki” by Gage Skidmore, CC BY-SA 2.0

What we cannot say is that the price of gold is up 50% year over year, so the price of housing must be up 50% year over year as well. That would be unwarranted extrapolation as the assets are not exactly correlated, they have their own markets. But given that they do tend to move together over the long run, we might want to look at this information more closely. If the price of gold is showing this sort of action, I would be willing to bet that the price of housing is going to melt up in a way that will make people woozy once the market starts to move.

Asset prices move in turns, as capital allocators cannot have all their money everywhere all at once. They generally rotate in and out of asset classes, resulting in a catch-up effect. When the stock market sold off in 2020 as a response to a major global shock, Bitcoin sold off as well, despite knowledge that the Federal Reserve would be stepping in with quantitative easing. Bitcoin was designed as a hedge against quantitative easing but did not see the light until allocators were ready to rotate their money into it. In March of 2020 Bitcoin was too speculative to receive safe haven status, but in October of 2020 animal spirits were unleashed and Bitcoin began to price in the monetary stimulus that had been enacted. So, looking back at Gold and Housing, is gold acting as a leading indicator or lagging indicator? As previously stated, my bet is leading.

Will Buying Gold Make You Rich?

Gold is not a productive asset; it will not make you anything. If all goes well, gold will function as a long-term store of value better than the US Dollar. What this means is that in order for you to “get rich” buying gold, you have to generate the value to get rich, then store it in gold. You accumulate “rich” over time by preserving the value you created over time. Additionally, the value you store in gold could perform better than other assets to such a degree where your growth in purchasing power elevates your wealth in a significant manner. An example of this would be if you bought a significant amount of gold, then gold outperformed housing to such a degree where it significantly improves your ability to buy a home. Receiving a home at such a discount could have an impact on your personal finances such that you are able to take advantage of the opportunity to further your wealth using other means.

However, if you are someone who finds it difficult to save money, gold may function as a tool for getting you more accustomed to building wealth. A great number of people who buy gold do so not because they have analyzed the universe of investable assets and determined gold was the best one. They buy gold because it is a way of saving money that feels like your spending money and you are receiving something physical in return, something that feels safe.

Why I Am Not Investing In Gold

Gold has done well, up 50% year-over-year, outperforming the S&P 500, which is only up 16% for the same period. I am not investing in gold primarily because my actively managed equity portfolio is up 87.45%. Even over a time period where gold has performed uncharacteristically well, I have outperformed it. Again, if you think 50% year-over-year returns is unheard of, you have not been paying attention. There are stocks that I can buy today that I expect to outperform gold tomorrow. Yes, my portfolio is going to inherently have more risk than gold, but allocating capital is not about avoiding risk, it is about managing it. With a stock portfolio, you get to choose between the universe of publicly traded companies to fit your risk tolerance at a given time. With gold, you are converting currency to commodity and sitting on it. Over the long run, I am confident that the investments I make in the stock market will outperform gold.

Furthermore, I do not have capital on the sidelines. Because I am comfortable with managing a portfolio of stocks, and see plenty of opportunity in the markets, any excess capital that I have is deployed. The cash that I hold is not “on the sidelines”, it has a purpose, and it needs to be liquid to fulfill that purpose. If I were to invest in gold, I would not buy a little bit here or there, I would buy a lot, establishing a real position. I see some value in picking up a couple of ounces as art, to own a piece of economic history. But as far as investments go, a 1 Kilo gold bar currently sits at about $136,000 and my wealth is not such that I am comfortable with investing that much money in an unproductive asset.

A Short Note on Gold Derivatives

There are various ways one could invest in gold without taking delivery of the shiny metal, paper contracts that derive their value from the spot price of gold. Such contracts are valuable in that they reduce the illiquidity problem of gold. You can buy them in your brokerage account, you do not have to worry as much about the bid-ask spread on the spot price of gold, and your investment size is not tied to the per ounce price of gold. However, I find these to be somewhat antithetical to the gold thesis, because you are not actually buying the gold, you are buying a contract.

I once heard a rumor that George Soros’ fund loaded up on such contracts during the Great Financial Crisis at the direction of The Palindrome himself. However, George was betting on financial system collapse and did not realize that his fund was not actually taking delivery of the gold. This was problematic because such contracts would be of questionable value if the financial system did collapse. When George learned of this oversight, he began to unload his position.

Additional Sources

Best, Richard. “How the U.S. Dollar Became the World’s Reserve Currency.” Investopedia, Investopedia, www.investopedia.com/articles/forex-currencies/092316/how-us-dollar-became-worlds-reserve-currency.asp. Accessed 26 Oct. 2025.

Taleb, Nassim Nicholas. Antifragile. Penguin, 2013.

Primary Image Source: “A gold bar shown on coins (Gold bars vs coins)” by BullionVault, CC BY-ND 2.0