Market Update 11/02/2025

On Thursday (October 30th, 2025), I set a new personal best for most dollars of net worth lost in a day. This is on a dollar not percent basis so the achievement is primarily reflective of my net worth increasing over time. The more you have, the more you have to lose, ergo, I see days like this as a badge of honor. They come with the territory.

This personal best was accomplished through changes in my equity market portfolio. On my last market update, published so late “Wednesday night” that it was Thursday morning, the market was relatively quiet and uneventful. Let’s take a look at what changed.

My Big Losers of the Day

To account for pre-market and after-hours trading and events, I have set our range of Thursday analysis to be from 10/29 Close to 10/31 Open.

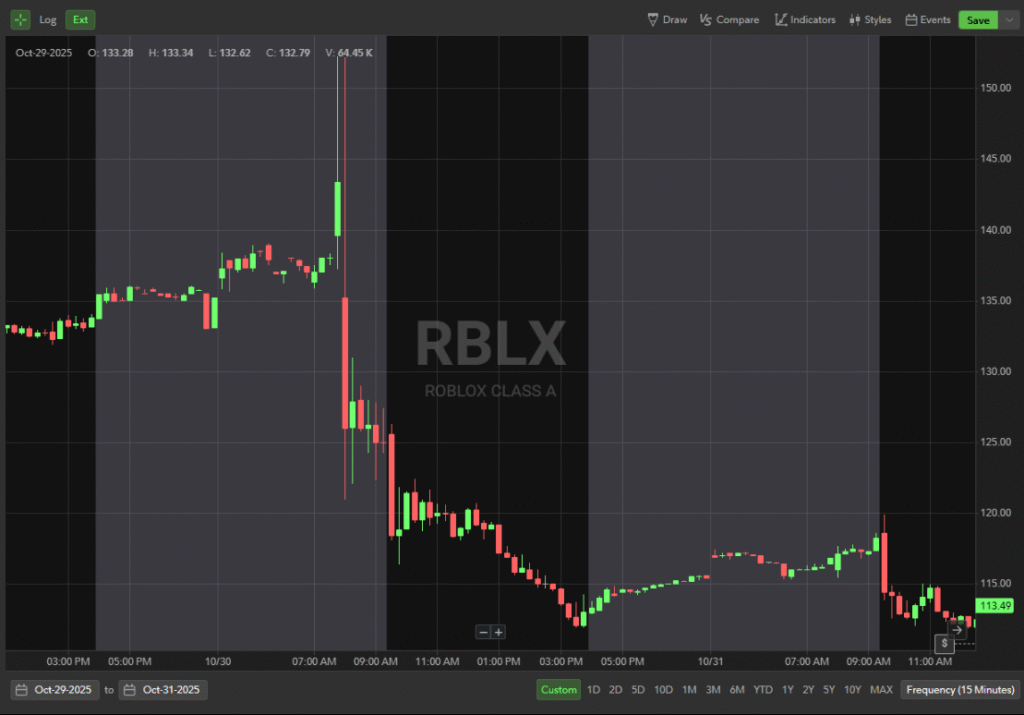

Roblox (RBLX): Down 12.28%. Gapped down, selling off 26.5% intraday in response to earnings, which were released 10/30 pre-market.

Meta Platforms (META): Down 10.90%. Released earnings after 10/29 close.

Altria (MO): Down 7.88%. Released earnings on 10/30 pre-market.

These companies are significant positions in my portfolio, meaning their combined sell-offs were enough to set the new personal best of most dollars “lost” in single day, marginally beating out the effects of Liberation Day.

What's With The Volatilty?

Presumably, my biggest losers sold off in response to their earnings. However, for each of these companies, I quite frankly do not understand the criticality based on what was actually reported. Now, I have never been the type of investor to over-analyze a quarterly report. I don’t care much for short term guidance or performance. Companies naturally move slowly and winners are determined over the long term. Maybe there is something of utmost importance hidden in each of these reports that only the event-based traders can decipher. Or maybe, people just have the jitters.

The "Big" Earnings Winners

A ton of companies reported earnings last week, those that got the most press for positive performance were Alphabet, Amazon, and Apple. Despite the press, the weekly performance of these “A” players was incredibly mediocre.

Alphabet (GOOGL): reported earnings on 10/29 after market close. Rallied, then lost a good portion of the gains. Finished the week up 6.77%

Apple (APPL): reported earnings on 10/30 after market close. Rallied, then lost all of the gains. Finished the week up 1.90%

Amazon (AMZN): reported earnings on 10/30 after market close. Rallied, then leveled out. Finished the week up 8.84%

It appears that the allocators who move markets were looking for an excuse to sell stock this past week. The companies that truly outperformed were simply spared, while those that looked funny were hammered.

What's Causing the Crackdown?

Macro, macro, macro. To understand why allocators have become so critical, we have to look at the macro:

- tariffs have clouded inflation measurements

- chip companies are raising the bar for outperformance

- tech companies are spending like mad on unproven business models

- gold is rallying

- the Fed is acting cautiously and diplomatically

- obscure finance companies are blowing up

- companies that sell real products to the real world are getting pummeled (like Newell Brands, NWL, down 31.68% last week and 65.94% year-to-date)

- private equity has the hiccups

There is a lot of FUD (Fear, Uncertainty, and Doubt) in the market. Jamie Dimon is warning of “cockroaches in the kitchen”. There may be cockroaches but it’s a Michelin Star restaurant. In fact, we have entered Ratatouille. The cockroaches are making the food and it tastes delicious. In other words, it’s a tale of two cities. You have real outperformance on one hand and real pain on the other. With market valuations and company performance amongst players becoming increasingly polarized, we are starting to see strain on how market functions interact with the real world.

The top 10 holdings in the S&P 500 make up 40.04% of the index. Of those ten, seven are tech companies whose primary functions are the facilitation of business for the rest of the economy. But the rest of the economy, their customers, cannot keep up. The economies of scale available to the top of the food chain is obscuring the troubles for those at the bottom, causing capital to migrate upwards.

Weakness In The Economy

The west as a whole has adopted a noble goal – the elimination of pain. But as man learns time and time again, it is pain that teaches us to value strength. Those paying attention have begun to see the social consequences that come with such optimism. The economic consequences are equally damning. All of the various protections and backdrops the United States has in place for its economy weigh on the market outcome of events such that we cannot possibly comprehend. The Federal Reserve has become a victim of its success. By mitigating the economic fallout of real-world events, it has allowed the weak to survive and the strong to thrive. Thus the weak have flourished and overgrown the fields of the economy, leaving the Fed a slave to an out of control weed. Overburdened by landscaping, they are rendered powerless over the strong.

Jittery capital allocators are a reflection of weakness, for the allocators themselves are weak. Their unfamiliarity with pain has led them to fear it, thinking it will bring down the strong. With the lines of weakness and strength blurred, either all are weak or all are strong. When they have lost their direction like this, allocators lose their freedom of choice, and the power that comes with it.

Where Does That Leave Us?

Allocators are going to have the jitters every time the real world rears its ugly head. They will forget about their jitters when the strong flex their might. Eventually, the dichotomy will become too much for them to stomach and they will sell indiscriminately. The backstops will save the day and the economy will get a little fatter, continuing to sleep walk toward obesity. One day it will be overpowered by a superior force and the whole house of cards will crumble.

What Are Our Options?

It is abundantly clear to me that the dinosaurs need to modernize or go extinct. There is only so much capital to be allocated and markets are becoming so competitive that inefficiency will be inexcusable to all but the government, even in an environment of easy money. If the weak companies in our economy are not going to be forced to adopt technology to survive, we have to teach them to value it. Advancements like AI and a more intelligent use of software in the real world could help close the gap between Amazon and the vendors it serves. Alternatively, these technologies could improve the efficiency of such companies to the point where they are able to scale down, being operated by much smaller administrations, so that they are instead competing with typical employment.