Market Update 10/29/2025

I spent most of today fantasizing about long dated LULU call options and found the market as a whole to be fairly tame. However, there were two events that made it on to my radar and may be worth keeping an eye on.

1. Chipotle Mexican Grill (CMG) Sold Off On Earnings

2. The Fed Cut Rates by 0.25%

Chipotle Mexigan Grill (CMG) - Sell Off

I keep a watchlist that currently consists of 190 interesting and recognizable companies. Today Chipotle (CMG) won the reward for biggest loser. They reported earnings after the bell and sold off from $40.26/share at close to the low $33 range ($33.39/share as I write this) in after-hours trading. On a percentage basis that’s ~16% since close and ~17% since open.

Why Did Chipotle Stock Sell Off Today?

In short – they reported earnings. Clearly, someone does not like what they reported.

If you are looking for explanations of intra-day stock movements, this is not the blog for you. I recommend mainstream news sources that are quick to report on the matrix of Sales & Earnings x Reported & Expectations. My investment style is not such that I care for the causes of earnings volatility, so long as the fundamental economics of businesses are not impacted in a significant manner. When I see Chipotle down 17% on a Wednesday, the “why?” is not as important as the “is there an opportunity here?”

Looking At The Bigger Picture

Chart Source: Fidelity Active Trader +

As the above chart shows, CMG was on the uptrend until it hit an all time high in the $69 range, mid-June of 2024. Since then the stock has been whipsawing, with large sell days followed by slow recoveries. From the big picture it looks like the stock had rallied quickly and is currently in a period of correction.

Given that the stock has an all time high of ~$69/share, it is worth noting that its current price of ~$33/share would mean a +100% upside in a scenario of a full recovery. Full recovery is not a given and in the world of investing, the timeframe for that recovery makes a big difference. After sell-offs, stocks can recover in 3 months, 30 years, never, and everything in-between. The economic journey of companies is long and uncertain. However, taking note of the high water mark is important because it tells us where the tide has been. That ~$69/share represents a market value for the company that was deemed justified at some point in the past. CMG was at all time highs 16 months ago, what has changed? What needs to change for it to return to that valuation?

The Larger Forces At Play

Looking at the stock’s performance, its current Price/Earnings ratio in the mid-30s, and having passively watched the sector over the past few years, here is the big picture narrative:

Chipotle was valued for aggressive growth but has lost steam in an inflationary environment where consumers are watching prices and costs are rising. The stock is experiencing enhanced volatility due to a fixation on consumer spending health.

My Takeaway From Today's Move

It is important to watch for consumer spending health. That said, my last visit to Chipotle left me shocked at the affordability. One of their burritos is plenty to feed me and they cost about $10 each. There does seem to be a group of vocal loyalists who notice every little price change and fill differential, but the value of the meal is still there on a real basis. The whole sector is facing increasing costs and Chipotle maintains a $10 meal at a reasonable profit margin. This suggests investors are too sensitive to their consumer weakness fears, resulting in undue volatility.

Taking a brief look at the financials, their reasonable margin has left them with a well capitalized balance sheet and solid cash flow to put to work. However, even with the sell off, their current Price/Earnings ratio suggests this performance is baked in, with a premium on top. For me to take a closer look at the company, I would need to see that premium gone. The last time the stock was trading at these levels was March of 2023, not much has changed regarding the financial status of the business since then.

The thought of owning a fast-food company with lots of employees and physical locations to worry about is somewhat unattractive in the modern economy. There are so many better business models, where management has real control over milestones that will multiply market caps. Looking at Chipotle, I am not sure what management can do to move the needle. Say the stock were to recover to its all time high, what then? Are they forever constrained by the limitations of the burrito?

If the stock were selling at a 2020 valuation, in the low $20/share range, when the business was quantitatively different, I would do a much deeper dive on their annual reporting and try to really understand how the business can win. Where the stock is currently trading, its not worth my investment, but it is worth notice.

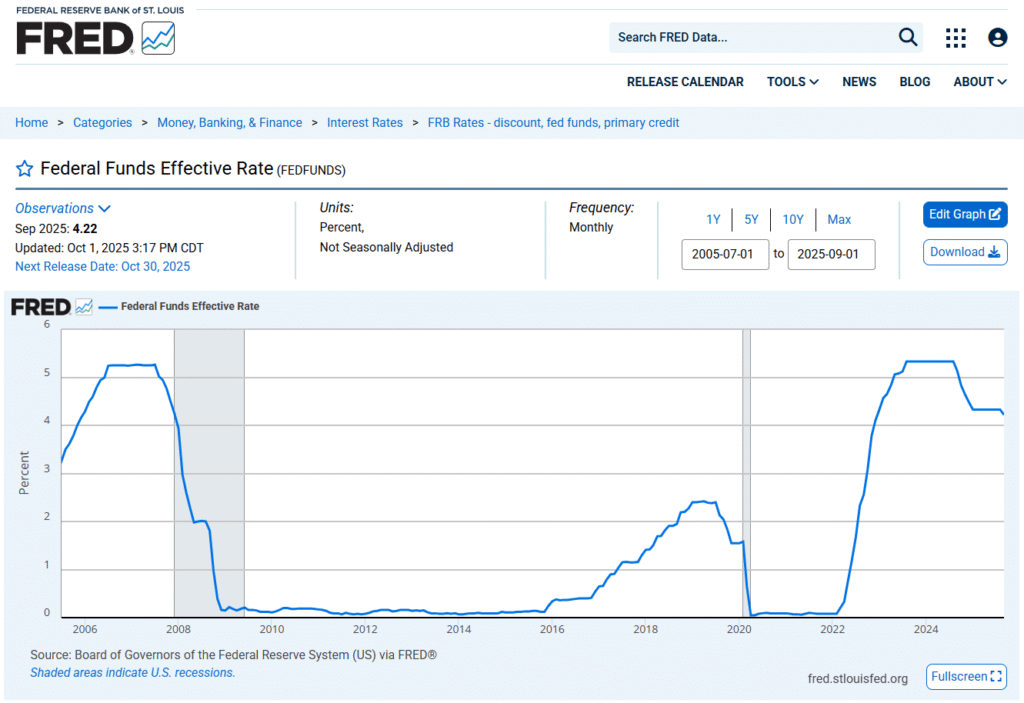

The Federal Reserve Cuts Rates By 0.25%

The other big news for today was that the Fed reduced the Fed Funds Rate by 0.25%. Much like the intra-day move for Chipotle Stock, I do not care too much about the specifics of this rate cut. Interest expense means very little over short term periods, it is the long term cost of interest that can truly be a burden. Again, we want to look at the bigger picture.

Chart Source: Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/series/FEDFUNDS

As shown in the graph above, the Fed has recently been decreasing rates, toward post-GFC levels. That matters more than today’s cut in isolation. A lower Fed Funds Rate leads to cheaper lending, which means easier business financing. A quarter point decrease is another step in that direction. Today’s cut is worth the mention, but the trend is worth noting, watching, and understanding.